Verify Claims Billing Information

- Last updated

-

-

Save as PDF

Updated: 12/17/2021

Views: 4718

If a claim was rejected due to billing information, follow the instructions below to verify the practice and provider billing information. When all corrective actions are completed, rebill and resubmit all affected claims.

Tip: Prevent future rejections by contacting the payer directly to verify the billing information and enrollment status they have on file. Then, ensure the payer's information matches the practice and provider information and settings prior to submitting claims.

Tip: Prevent future rejections by contacting the payer directly to verify the billing information and enrollment status they have on file. Then, ensure the payer's information matches the practice and provider information and settings prior to submitting claims.

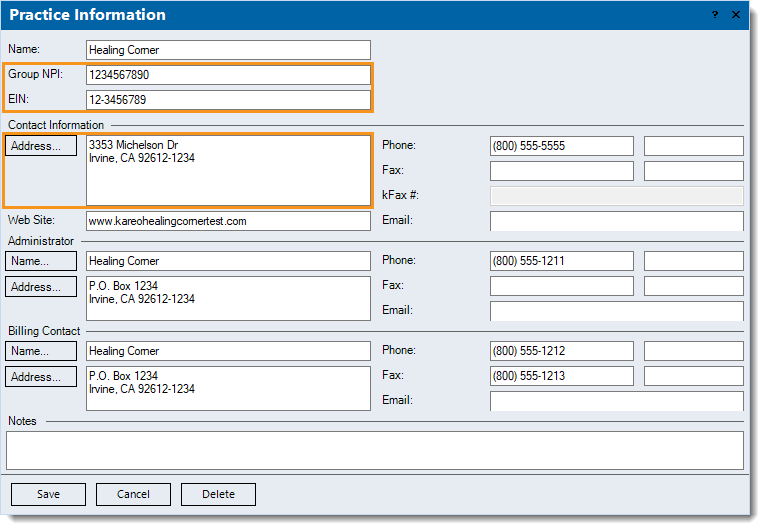

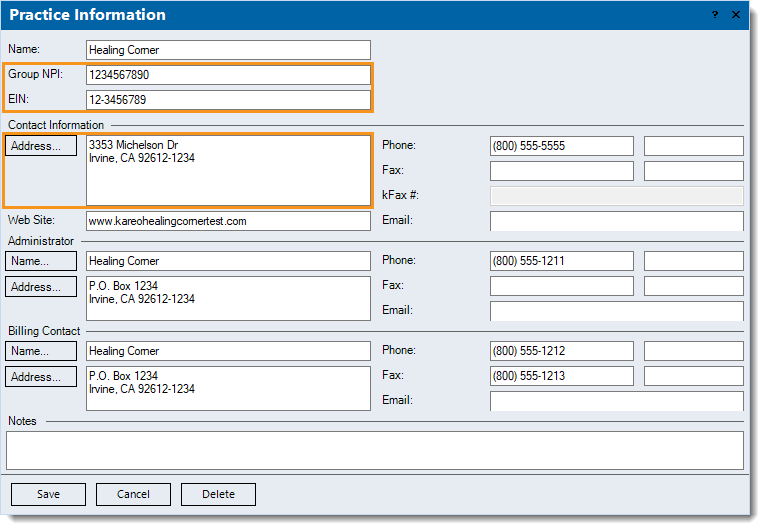

Practice Information

The Group NPI, Tax ID, and Contact Address entered in the Practice Information record is used to bill all insurance companies for all providers unless the provider has claim settings overrides.

Follow the steps below to verify the practice information:

- Click Settings > Practice Information. The Practice Information window opens.

- Verify the following information for accuracy and edit as necessary.

- Group NPI: If credentialed to bill with a group NPI, verify the NPI entered is correct and not an individual NPI.

Note: The individual NPI is entered in the Provider record.

- EIN: If credentialed to bill with an EIN or Tax ID, verify the number is correct.

Note: For providers credentialed to bill using their SSN, the SSN is entered in the Provider record.

- Address: Under the Contact Information section, use the USPS zip code lookup tool to verify the practice address is correct. The address must be a physical address (cannot be a P.O. Box) with a valid 9-digit zip code.

- To save any corrections made, click Save.

|

|

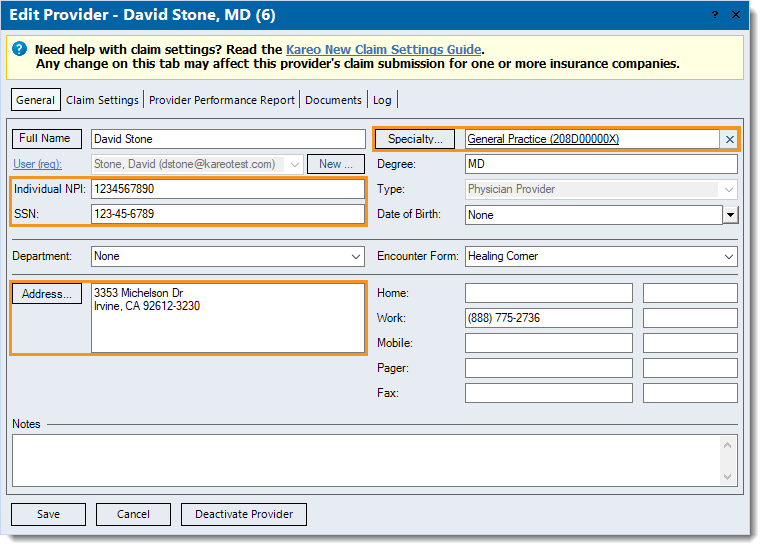

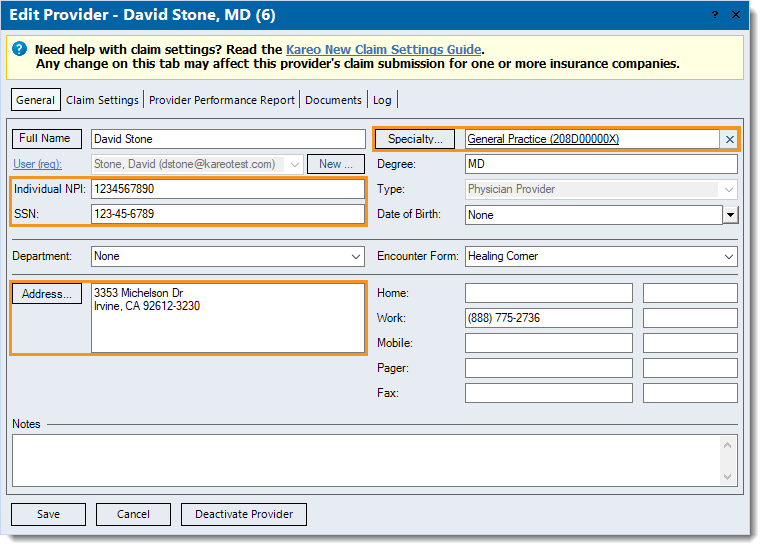

Provider Information

The Individual NPI, SSN, Specialty, and Address entered in the Provider record is used to bill all insurance companies unless the provider has claim settings overrides.

Follow the steps below to verify the practice information:

- Click Settings > Providers. The Find Provider window opens.

- Find the provider then double click to open. The General tab of the Edit Provider window opens by default.

- Under the General tab, verify the following information for accuracy and edit as necessary.

- Individual NPI: Verify the NPI entered is correct. The individual NPI should match the NPPES NPI Registry.

- SSN: If applicable, verify the SSN entered is correct.

- Specialty: Verify the specialty is correct. To search and select the appropriate specialty from the list of taxonomy codes, click Specialty.

- Address: Use the USPS zip code lookup tool to verify the provider's office address is correct. The address must be a physical address (cannot be a P.O. Box) with a valid 9-digit zip code.

- Click Save until the Confirmation pop-up appears in order to confirm any corrections made.

|

|

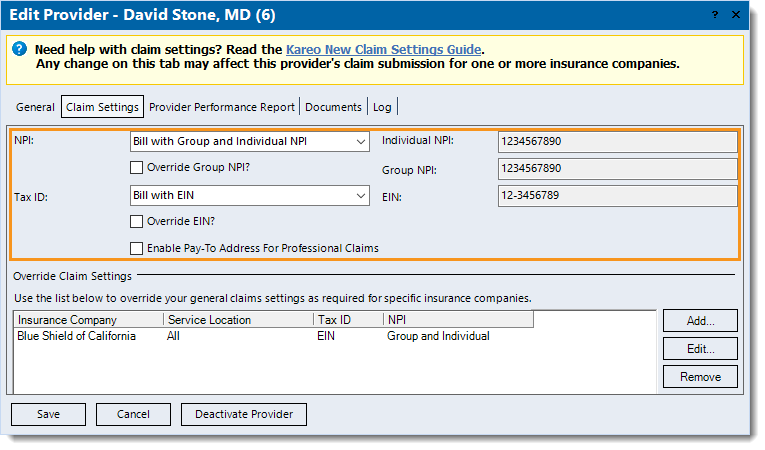

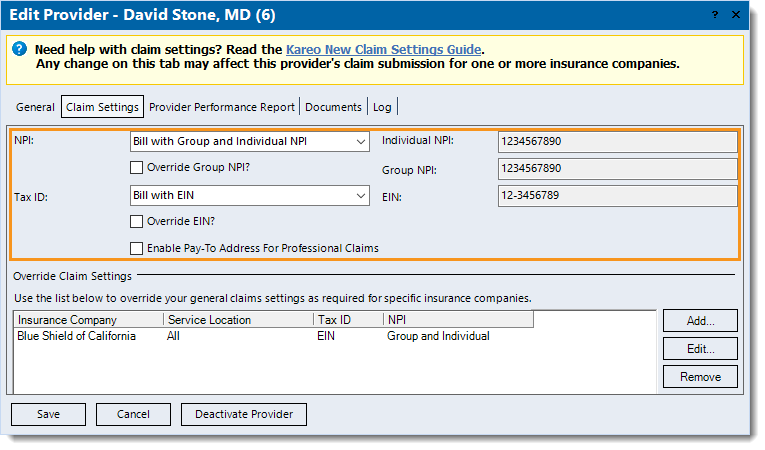

Provider Claim Settings

The NPI and Tax ID under the Claim Settings tab of the Provider record is used to bill all insurance companies unless the provider has claim settings overrides.

Follow the steps below to verify the provider's claim settings:

- Navigate to the Provider Claim Settings.

- Verify the following information for accuracy and edit as necessary.

- NPI: Verify the default billing NPI is set correctly. To change the setting, click the drop-down arrow.

Note: The Individual NPI auto-populates from the General tab and the Group NPI auto-populates from the Practice Information.

- If Bill with Group and Individual NPI is selected, but this provider's claims need to be sent with a different Group NPI, click to select "Override Group NPI?" and enter the Override Group NPI.

- Tax ID: Verify the billing Tax ID is set correctly. To change the setting, click the drop-down arrow.

Note: The EIN auto-populates from the Practice Information and the SSN auto-populates from the General tab.

- If this provider's claims need to be sent with a different EIN, click to select "Override EIN?" and enter the EIN Override.

- If "Enable Pay-To Address for Professional Claim" is selected because the pay-to address (e.g., P.O. Box or Lockbox) differs from the practice's address, use the USPS zip code lookup tool to verify the address with a 9-digit zip code is correct.

- Click Save until the Confirmation pop-up appears in order to confirm any corrections made.

|

|

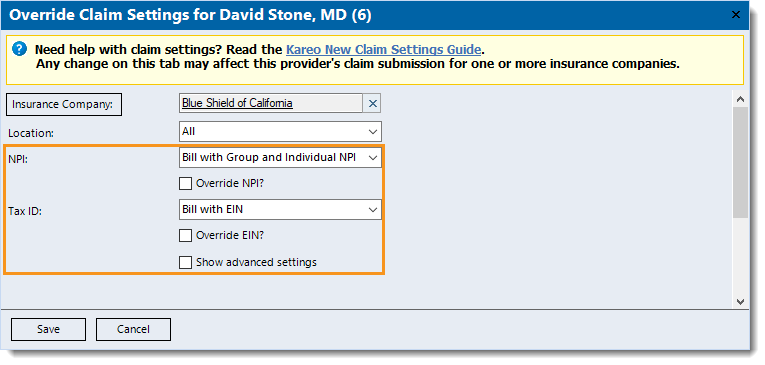

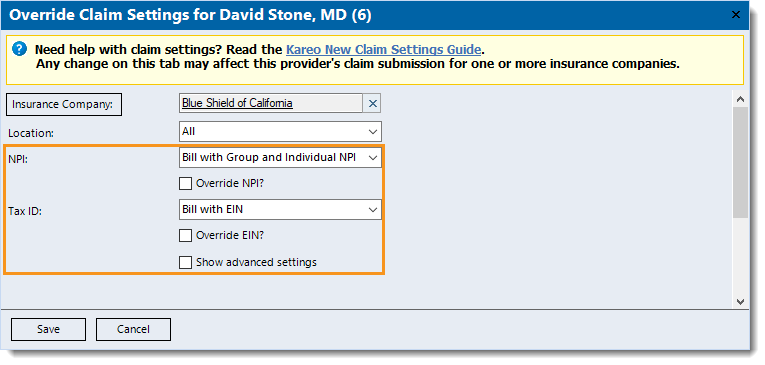

Provider Claim Settings Override

Claim settings overrides are used for any insurance company and/or service location that has exceptions to the provider's general claim settings. If an override needs to be created, review Override Claim Settings.

Follow the steps below to verify the provider's claim settings override(s):

- Navigate to the Provider Claim Settings.

- Under the Override Claim Settings section, double click the appropriate insurance override to open. The Override Claim Settings window opens.

- Verify the following information for accuracy and edit as necessary.

- NPI: Verify the billing NPI is set correctly. To change the setting, click the drop-down arrow.

- If the provider's claims need to be sent with a different Group or Individual NPI, click to select "Override NPI?". Then, enter the Group NPI Override or Individual NPI Override.

- Tax ID: Verify the billing Tax ID is set correctly. To change the setting, click the drop-down arrow.

Note: The EIN auto-populates from the Practice Information and the SSN auto-populates from the General tab.

- If this provider's claims need to be sent with a different EIN, click to select "Override EIN?" and enter the EIN Override.

- To verify advanced settings, click to select "Show advanced settings" and review Advanced Provider Override Settings.

- Click Save until the Confirmation pop-up appears in order to confirm any corrections made.

|

|

![]() Tip: Prevent future rejections by contacting the payer directly to verify the billing information and enrollment status they have on file. Then, ensure the payer's information matches the practice and provider information and settings prior to submitting claims.

Tip: Prevent future rejections by contacting the payer directly to verify the billing information and enrollment status they have on file. Then, ensure the payer's information matches the practice and provider information and settings prior to submitting claims.